nebraska sales tax calculator

Enter the Product Service Cost. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item.

Car Tax By State Usa Manual Car Sales Tax Calculator

Choose Normal view to work with the calculator within the surrounding menu and supporting information or select Full Page View to use a focused view of the Nebraska Sales Tax Comparison Calculator.

. The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0825 for a total of 6325. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Fairbury Nebraska.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. The state sales tax in Nebraska is 550. How to Register for Nebraska Sales Tax.

The table below shows the. Colorado has the lowest sales tax at 29 while California has the highest rate at 725. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

This can be found on IRS Form 1040. Invoicing clients or selling to customers and need to know how much sales tax to charge. With local taxes the total sales tax rate is between 5500 and 8000.

Sales Tax Calculator Calculate CALCULATING Before Tax Amount000 Sales Tax000 Plus Tax Amount000 Minus Tax Amount000 If youre selling an item and want to receive 000after taxes youll need to sell for 000. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. Download state rate tables Get a free download of average rates by ZIP code for each state you select.

The Nebraska State Sales Tax is collected by the merchant on all qualifying sales made within. Reduce audit risk as your business gets more complex. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Divide tax percentage by 100 to get tax rate as a decimal. 1500 - Registration fee for passenger and leased vehicles. 2017 Nebraska Tax Incentives Annual Report.

Five states have no sales tax. In the state of Nebraska sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

How to Calculate Sales Tax. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Tax Rate Starting Price Price Increment Nebraska Sales Tax Table at 7 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax 100 007 120 008 140 010 160 011 180 013.

Nebraska Sales Tax Rate The sales tax rate in Nebraska is 55. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. Nebraska Department of Economic Development.

Top marginal rates for state income tax in 2020 ranged from 29 percent in North Dakota to 133 percent in Californiaincluding a 1 percent surcharge on incomes over 1 million. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Nebraska state sales tax rate range 55-75 Base state sales tax rate 55 Local rate range 0-2 Total rate range 55-75 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates.

The Nebraska state sales and use tax rate is 55 055. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected.

Sales Tax Calculator Calculate CALCULATING Before Tax Amount000 Sales Tax000 Plus Tax Amount000 Minus Tax Amount000 If youre selling an item and want to receive 000after taxes youll need to sell for 000. Ad Integrates Directly w Industry-Leading ERPs. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

Then use this number in the multiplication process. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Select the Nebraska city from the list of popular cities below to see its current sales tax rate.

To determine the income with which to calculate your tax bill in Nebraska you begin with your federal adjusted gross income AGI. Nebraska has a state sales and use tax rate of 55. Shipping charges are taxable in Nebraska even if listed separately from the.

Multiply the price of your item or service by the tax rate. Find list price and tax percentage. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Nine states impose a single tax rate on all income while Hawaii has the most with 12 tax brackets and rates. Input the amount and the sales tax rate select whether to include or exclude sales tax and the calculator will do the rest.

Nebraska Sales Tax Calculator. This can be the amount after sales tax or before Sales tax you can choose which at step two. Should you collect sales tax on shipping charges in Nebraska.

In addition to that many cities collect their own sales taxes with rates up to 250. Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Lincoln Nebraska.

Sales Tax Rate s c l sr Where. ArcGIS Web Application - Nebraska. Exemptions from sales tax in Nebraska include groceries prescription medications and most medical equipment.

Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. The Registration Fees are assessed. Nebraska has recent rate changes Thu Jul 01 2021.

Sales Taxes In The United States Wikiwand

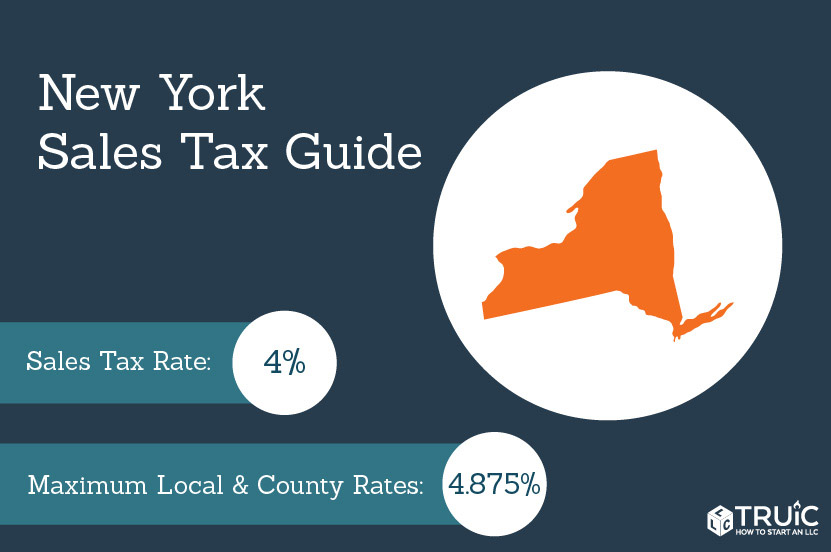

New York Sales Tax Calculator Reverse Sales Dremployee

Don T Die In Nebraska How The County Inheritance Tax Works

States With Highest And Lowest Sales Tax Rates

Nebraska Sales Tax Rates By City County 2022

11 9 Sales Tax Calculator Template

Nebraska Sales Tax Information Sales Tax Rates And Deadlines

![]()

Nebraska Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Certificate Of Authority New York Sales Tax Truic

Sales Tax On Grocery Items Taxjar

What Is Sales Tax A Complete Guide Taxjar

Nebraska Sales Tax Guide And Calculator 2022 Taxjar